SergeYatunin/iStock Editorial by means of Getty Pictures

Introduction Thesis

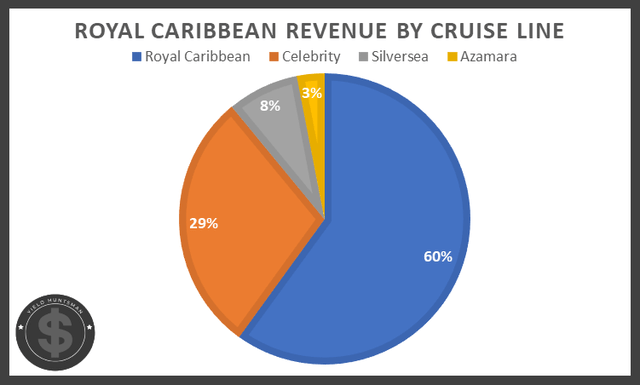

Royal Caribbean Cruises (NYSE:RCL) operates as a result of a few primary cruise traces to supply a multitude of cruising itineraries all over the globe. The business presently capabilities with 62 passenger ships, which include five of the world’s largest, with an additional 11 on purchase for eventual provider. With 54 decades of experience in the market, it has accomplished an fantastic career with capitalizing on the probable its ships consist of and monetizing travellers to the most effective of its ability. Its mixed 24% share of the worldwide cruising market locations RCL 2nd in passenger capability and enables diversification both equally in phrases of value and accessible itineraries.

Yield Huntsman and Royal Caribbean Cruises

These strains, at just one issue, contributed to additional than $10B in yearly profits on the other hand, extra a short while ago, they created a mere fifth of what they after did. Reflecting this, share prices fell from all-time highs around $135 to the reduced $20s, and adhering to a short restoration, shares are once again buying and selling at an particularly low valuation. With ship occupancy costs continually trending increased, a selection of operational advancements ought to assist in driving shareholder returns very well higher than their historic highs. In blend with share price ranges achieving a considerable stage of technological help, now is an great time to establish a situation in Royal Caribbean Cruises.

Improving upon Functions

It is no doubt complicated to seem earlier the economical challenges introduced on by the Coronavirus, in particular within just the cruising sector. However, Royal Caribbean offers improvements to quite a few key metrics that should really, at some point, outweigh the difficulties faced throughout substantially of 2020 and 2021. Empowered by an strengthening fleet of ships, higher occupancy prices are letting the enterprise to just take edge of the highest earnings for each passenger observed. Incorporate in its potential to alter prices accordingly, Royal Caribbean really should exit the pandemic operationally more powerful than ever.

Additional Ships

Given that the starting of 2021, 5 outstanding ships have been additional to the, now, 100% working fleet. Specified every marketplace in which it operates, other than China, is now open for cruising, Royal Caribbean intends to get full gain of its ship-constructing talents with the prepared addition of 10 vessels. These further ships, together with a new “Icon Class” that’s predicted to carry out along with its largest ships in conditions of dimension, are meant to include to the now-constructive functioning money movement. The continued fleet enlargement alerts not only the supplemental need that the enterprise is facing from vacationers but the certainty among management that this sort of investments are worthwhile.

Bigger Load Elements

Even though not nevertheless at pre-pandemic ranges, robust ship occupancy fees are expected to carry on mounting, even with a larger sized fleet for travellers to fill. As of the to start with quarter, ships were being working with approximately 68% of their rooms occupied this figure was anticipated to be in the upper 70% selection by the time they report Q2 earnings (August 2nd). Despite lower load factors, bookings for this period of time are on the lookout immensely robust in terms of cruising need. Main Government Officer Jason Liberty experienced the next to say during the very first quarter earnings contact:

Bookings improved each and every week throughout the initial quarter, as the affect from Omicron light. For the earlier eight months, bookings have been meaningfully better than 2019 with specific power in North American itineraries” (Q1 Earnings Connect with).

Fortunately, Royal Caribbean is not having for granted this chance to seriously monetize added travellers when, in latest yrs, it is been not able to. In change, this has yielded report revenue for each passenger that should go on when load factors return to standard.

Document Revenues Per Passenger

Generating use of each more ships and greater crowds remaining brought to its cruise lines, Royal Caribbean has just lately recorded its best-at any time revenue per passenger. As opposed to the similar interval in 2019, earnings per visitor is up 4% and management attributes this feat mostly to its newly applied pre-cruise arranging process that incentivizes greater expending before even environment foot on its ships. These buyer deposit balances greater by $400 million all over the to start with quarter and level to larger investing not only on current voyages but also on upcoming cruises, thinking of 27% of these credits are finally devoted to this kind of expenditures.

Pricing Overall flexibility

As cruise potential boosts, administration is also getting take note of its passengers’ willingness to spend while each arranging and on their holidays. As you can picture, ship occupants are fairly restricted in terms of acquiring meals and essential necessities, and with that, Royal Caribbean is doing work to increase its prices appropriately. Specially attractive is its observation that travellers very easily accommodate individuals heightened charges presented the cruise atmosphere.

[W]hat we do see is as the purchaser starts to gravitate in direction of higher pricing, as they get calibrated to what they are paying out for a resort space, or they are having to pay for other services and restaurants and so forth” (Q1 Earnings Phone).

With an increase in passengers that can be accommodated, the skill to further more monetize mentioned shoppers should really translate into a long run of enormous income for Royal Caribbean.

Valuation

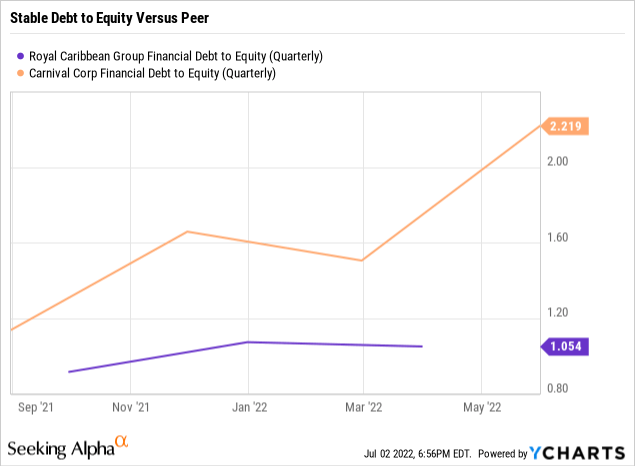

The decline of profitability for Royal Caribbean makes specified valuation procedures reasonably hard, especially when accounting for its formerly robust earnings. Inspite of this, administration expects profitability for the latter half of 2022 and combined with lessening credit card debt loads and strengthening operations, the recent valuation appears to present a deep discounted to what is possible in the coming months as soon as the balance sheet has primarily recovered. In looking to public comparables to achieve an comprehending of wherever Royal Caribbean stands, it looks rivals like Carnival Company (CCL) are keeping high personal debt stages in spite of no around-term expectations of profitability. On the other hand, Royal Caribbean has been paying out off higher-fascination credit card debt many thanks to its touted liquidity and refinancing outstanding loans.

In contrast to peers, confined leverage is currently being put to use by Royal Caribbean (demonstrated by a reasonable Personal debt to Equity Ratio) to the two sustain and expand operations. Its smaller sized personal debt loads are primarily eye-catching in combination with significant liquidity that should let it to temperature most added, small-phrase, difficulties. As Chief Economical Officer Naftali Holtz mentioned in the firm’s to start with quarter earnings get in touch with:

Ending the quarter with $3.8 billion in liquidity. We have ample liquidity to enable us to continue our restoration trajectory” (Q1 Earnings Get in touch with).

This robust, and increasing, equilibrium sheet ought to reduce current fears that have put immense pressure on the company’s valuation additionally, actions are currently being set into position to counter potential dangers to its recovery.

Challenges Moving Forward

Inspite of the operational advancements highlighted earlier mentioned, the pitfalls which initiated this steep tumble in profits continue to be to some extent on the other hand, management is absolutely acknowledging these dangers and going to restrict their influence. Past the noticeable impacts of the Coronavirus, heightened inflation and gasoline selling prices still existing a moderate level of possibility to Royal Caribbean’s return to normalcy. On the former, inflation has triggered costs for most food items and personnel to boost having said that, specified the before-pointed out pricing power that cruises preserve specified their enclosed environments, this danger has been mitigated rather well as charges onboard can comfortably raise in line with inflation. Turning to gas price ranges, administration brazenly talked about this chance and manufactured point out of what it is performing to lessen this issues:

On the gas side, we keep on to enhance intake and have partially hedged charge under marketplace costs, which is mitigating the impression on our gasoline expenses” (Q1 Earnings Connect with).

In addition to hedging 55% of its fuel costs for 2022, 8 of the firm’s most modern ships are in the variety of 30%-35% more fuel-successful than their predecessors. This trend is set to continue on given the prepared implementation of liquefied organic fuel. This gas is much less expensive than low-sulfur gas used by other ships and also fewer-donning on motor elements, together, generating a much more charge-productive alternative to ongoing sailing.

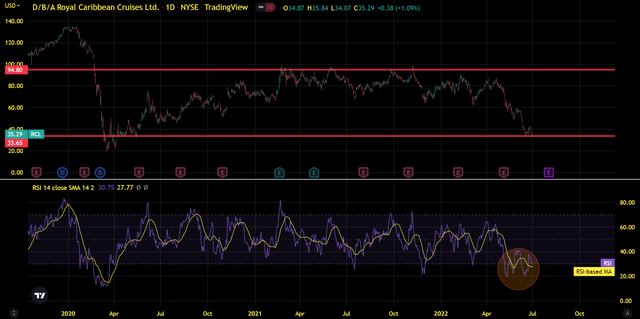

Specialized Assessment

As shares trade at charges not observed considering the fact that cruising was suspended around the globe, the possible for a sturdy comeback now is far much better than it was then. Elementary power must proceed improving upon in light-weight of the quite a few favorable tendencies. Contemplating the challenges which traders have priced in and the ability for administration to change accordingly to these potential problems, the selloff appears to offer an superb chance to build a place as hard cash stream, and other metrics, turn positive.

TradingView

Based off a channel that has formed around the past two decades, shares appear to be acquiring help beforehand set up in the $30 location. This, coupled with an entrance into oversold territory according to the Relative Strength Index (RSI), details to a promising short-phrase rebound in share rates. As this quick-phrase rebound takes place, there’s a powerful chance that the anticipated improvement in fundamentals carries on these gains, most likely to concentrations accomplished in 2021.

Remaining Thoughts

Fearing whether Royal Caribbean had a practical approach to overcome more difficulties in the two the near and lengthy time period upcoming, share rates now trade extremely near to in which they ended up for the duration of the Covid-induced crash of 2020. Even with these fears, numerous catalysts have placed Royal Caribbean on an outstanding trajectory for equally its restoration and future growth. In order to acquire advantage of these promising developments, specially as technological variables appear to ignite a brief-phrase improve in share costs, now appears to be an fantastic time to construct a position prior to this immense price getting realized.